does instacart automatically take out taxes

The rate from January 1 to June 30 2022 is 585 cents per mile. You have to pay your.

The Ultimate Guide To Self Employed Taxes Everlance

Do Instacart and Shipt take out taxes.

. Does Instacart take out taxes for its employees. But Instacart pays its in-store shoppers a base pay of 10 per hour plus commission through the. When a customer is shopping and an item is out of stock you will let them know and work with them to find a suitable replacement.

Instacart shoppers typically file personal tax returns by April 15th for the income you earned from January 1st to December 31st the prior year. The rate for the 2022 tax year is 625 cents per mile for business use starting from July 1. The taxes andor fees you pay for products purchased through the Instacart platform are calculated in the same way as in a brick and mortar store.

Everybody who makes income in the US. This includes self-employment taxes and income taxes. If you earned at least 600 delivery groceries over the course of the year including base pay.

Missouri does theirs by mail. The taxes on your Instacart income wont be high since. As youre liable for paying the essential state and government income taxes on the cash you make delivering for Instacart.

But Instacart pays its in-store shoppers a base pay of 10 per hour plus commission through the. You can find the breakdown of specific fees below. Has to pay taxes.

Bestreferral Team April 16 2022 Reading Time. They do not automatically take out taxes. However Instacart will automatically take out your taxes if youre an in-store shopper.

Instacart fees and taxes Instacart charges fees based on the services being offered. If taxes drive you crazy youre not alone. For its part-time shoppers.

Does Instacart take taxes out of. Whether you choose to work for. Do Instacart take out taxes.

The short answer is no if youre an Instacart full-time shopper. Instacart doesnt take out taxes. For its part-time shoppers Instacart doesnt take out taxes and they file W-2s.

Estimate what you think your income will be and multiply by the various tax rates. If you make more than 600 per tax year theyll send you a 1099-MISC tax form. This means that DoorDashers will get a 1099-NEC form from DoorDash.

Delivery fee Instacart delivery starts at 399 for same. To actually file your Instacart taxes youll need the right tax form. This is a standard tax form for contract workers.

Does Instacart Take Out Taxes. Instacart doesnt pay for gas or other expenses. Since in-store shoppers are traditional part-time employees Instacart handles withholding money for taxes.

Instacart shoppers are required to file a tax return and pay taxes if they make over 400 in a year. For Instacart users how do taxes work with Instacart. DoorDash will provide its earnings and that earnings will be presented on the 1099-NEC form.

What Taxes Do Instacart Shoppers Need to Pay. You can deduct tolls and parking. Youll need to set aside money to pay taxes each quarter more below.

For gig workers like Instacart shoppers they are required to file a tax return and pay taxes if they make over 400 in a year. Instacart delivery starts at 399 for same-day. For simplicity my accountant suggested using 30 to estimate taxes.

Ultimate Tax Filing Guide. As an independent contractor you must pay taxes on your Instacart earnings.

Instacart Q A 2020 Taxes Tips And More Youtube

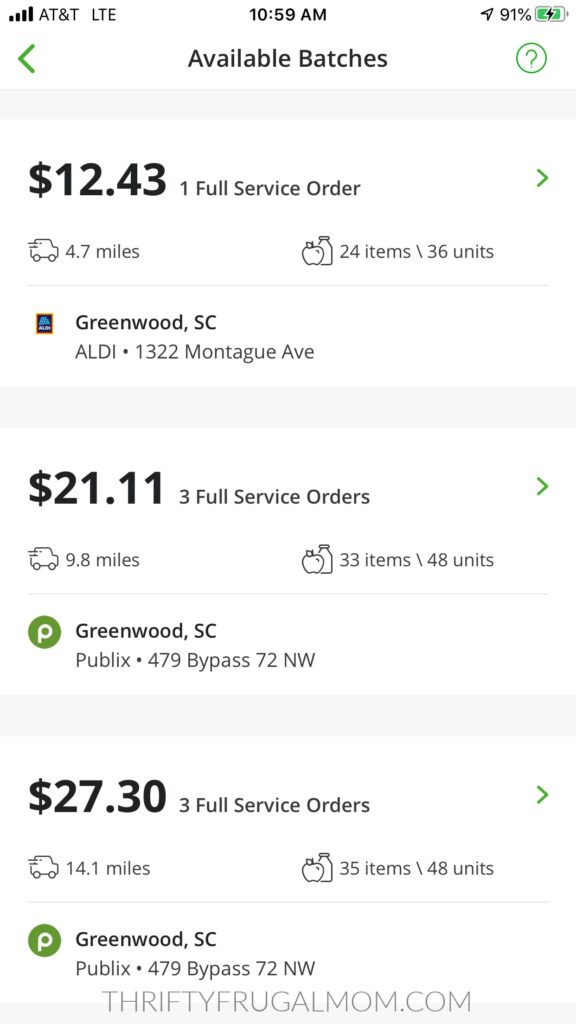

Instacart Shopper Review Made Over 1 550 Mo Working Part Time Thrifty Frugal Mom

Instacart Launches Instacart A New And Improved Subscription Service With Free Delivery Options Reduced Service Fees Savings On Every Order And Family Shopping Features

Does Instacart Track Mileage The Ultimate Guide For Shoppers

What You Need To Know About Instacart Taxes Net Pay Advance

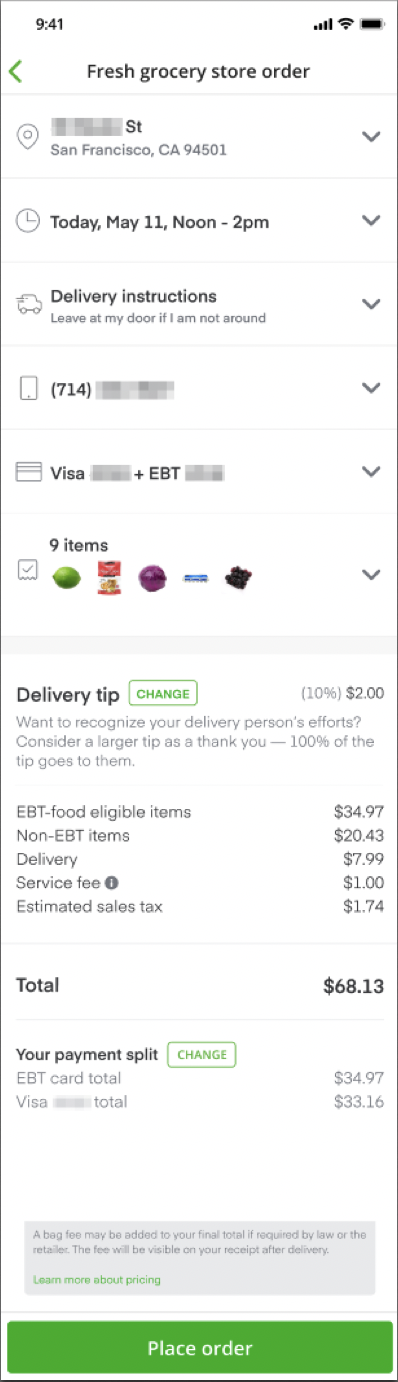

Instacart Help Center Checking Out With Your Ebt Card

Instacart Taxes The Complete Guide For Shoppers Ridester Com

How To File Your Taxes As A Food Delivery Driver Grubhub Doordash Instacart Dumpling Etc Contact Free Taxes

How To Get Instacart Tax 1099 Forms Youtube

I Saved Money On Instacart Delivery With A Credit Card Promotion

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

What You Need To Know About Instacart Taxes Net Pay Advance

All You Need To Know About Instacart 1099 Taxes

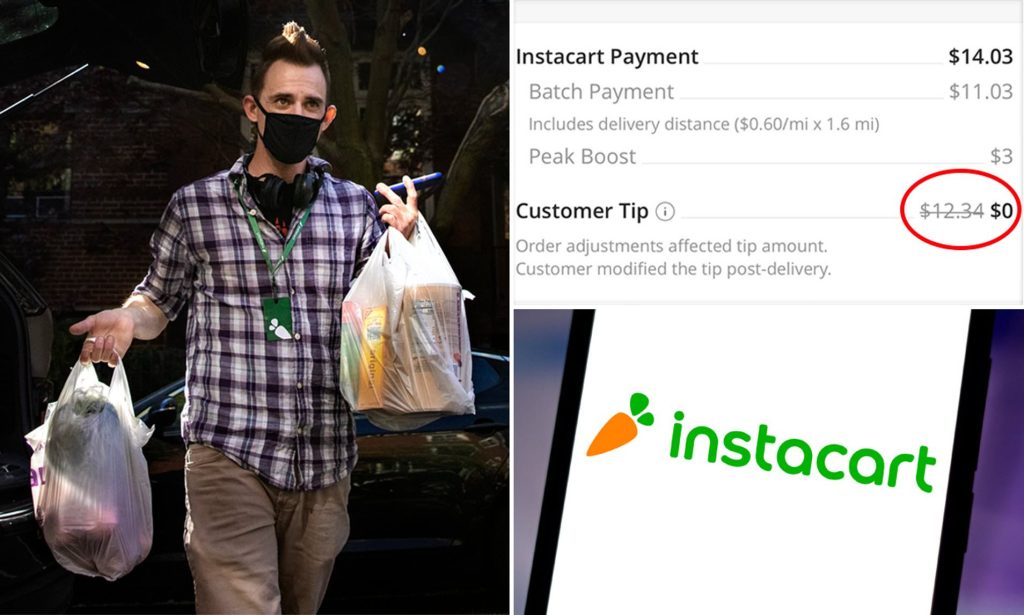

Instacart Tipping Etiquette How Much Am I Supposed To Tip

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Instacart Driver Review 10k As A Part Time Instacart Shopper

9 Different Ways To Legally Avoid Taxes On Cryptocurrency Financebuzz

How To Handle Your Instacart 1099 Taxes Like A Pro

Instacart Driver Review 10k As A Part Time Instacart Shopper